One June 21st the Supreme Court of the United States ruled 5-4 to overturn the 1992 case Quill v. North Dakota which will now allow states (and counties) to collect sales tax from online and out-of-state retailers.

A lot of our merchants and readers may be wondering how this effects the average every day business selling products online. What this means is that a state or county can legally require ecommerce merchants to report/charge sales tax in that given area regardless of a physical presence.

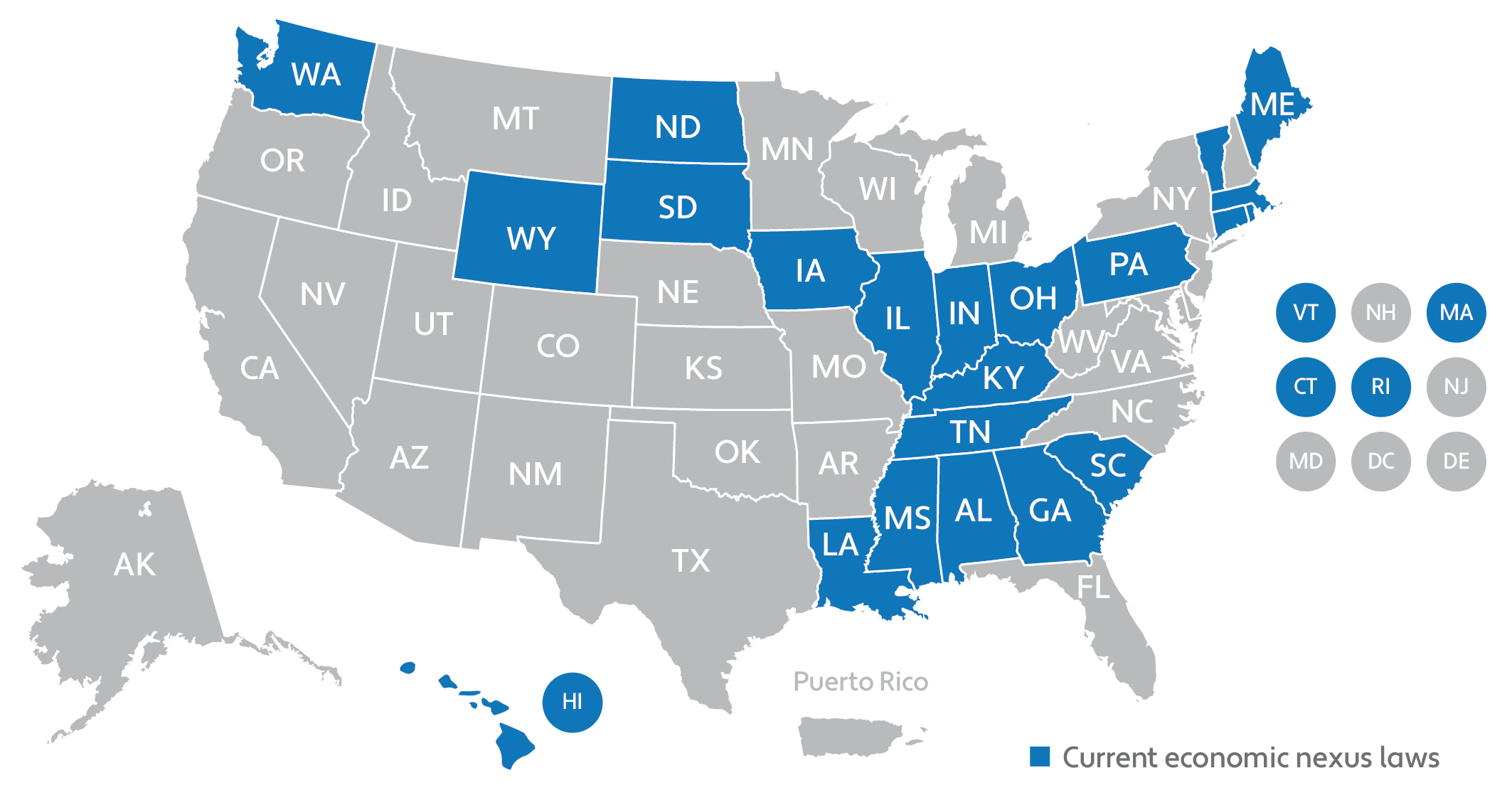

Economic Nexus

Economic nexus is a tax obligation imposed on online stores or companies that have a certain level of sales within that state. The “economic nexus criteria” used by states to determine whether a retailer is liable for sales taxes vary by state (or county) so it is important to know each state’s tax laws on the matter as they may all be different.

For example, the economic nexus in South Dakota states that an online merchant must have $100,000 in taxable sales and/or 200 separate taxable transactions delivered into South Dakota in the same or previous year. But this just one example as other states have completely different laws regarding their economic nexus. Ohio’s law, for example, kicks in when a merchant has $500,000 of taxable receipts in that state. Wild.

Each state has its own rules for sales tax and some states don’t even have a trigger for economic nexus. In some states it’s the counties and cities that maintain that make the rules which means merchants may need to keep a close ear to the ground on legal changes across the United States.

Legislation Changes

Yeah. Big news if you’re operating an ecommerce store. The good news is that it’s so impactful, that it may take quite some time for the law to take place and go into effect. Look for new legislature by Congress to take action on other policies in response to this ruling (for example the Online Sales Simplification Act).

Then again if Congress does nothing, it could be entirely up to the States to make certain rulings when it comes to their economic nexus. Which, just typing that seems like a mess.

Is there any help out there?

Avalara is a preferred partner of AmeriCommerce and just so happens to be the world’s leading tax integration software (they live for stuff like this). Luckily you can easily access Avalara and all their features from inside your online store with a very deep integration.

Avalara is a preferred partner of AmeriCommerce and just so happens to be the world’s leading tax integration software (they live for stuff like this). Luckily you can easily access Avalara and all their features from inside your online store with a very deep integration.

Avalara’s AvaTax provides up-to-the-minute calculation accuracy (including new laws), geolocation to pinpoint districts and rates, and automated filing across over 12,000+ jurisdictions.

Avalara has a FREE AvaTax trial for AmeriCommerce users which you can take advantage of.

Editing Sales Tax in Your Online Store

Due the powerful capabilities of the AmeriCommerce platform you easily adjust tax rates on your online store by going to Settings > Payments and Taxes. If you have any issues creating your tax rates, our AmeriCommerce support team can help answer any questions you have and guide you through it.

We’ll always be here to guide you through the ever-changing landscapes of the ecommerce industry and we’re not stopping now. As we see updates, we’ll let our customers know asap. In the meantime, do what you do best – Sell Stuff!

Happy Selling!

-AmeriCommerce Team